An interview with Draper Dragon Managing Partner Richard Wang: RWA, DePIN, and AI’s Potential to Disrupt Markets

The managing partner of this globally renowned investment firm emphasized that general-purpose large models are not suitable for specialized fields; instead, what’s needed are domain-specific models. This creates a significant opportunity for entrepreneurial teams. Blockchain can play a crucial role in empowering AI across three key areas: computing power, data, and algorithms.

“Investors Unplugged” is a cutting-edge dialogue series from Starlabs Consulting that probes into the heart of global investment trends. This program connects audiences with leading global investment institutions, creating a dynamic platform where entrepreneurs and investors can explore the landscape of investment in disruptive technologies. Distinguished investors will share their insights and strategies, illuminate the pathways to innovative financing, and predict future trends within the investment community. As a cornerstone resource, this series is invaluable for stakeholders throughout the technology ecosystem.

This edition of “Investors Unplugged” features a conversation with Mr. Richard Wang (LinkedIN), managing partner at Draper Dragon, discussing topics including Web 3.0, artificial intelligence, blockchain, and the technological innovations, development stages, and trends within the crypto industry, as well as the regulatory environment, offering enlightening insights for assessing industry situations and clarifying investment contexts.

Draper Dragon Innovation originates from the Silicon Valley-based DFJ Fund and was co-founded in 2005 by some of the world’s most influential venture capitalists and China’s first-generation venture capital leaders. The firm has globally invested in and nurtured several tech unicorns, such as Coinbase (Nasdaq: COIN), HKbitEX, VirgoCX, CoinDCX, Ledger, Otter.ai, VeChain ($VET), IOTEX ($IOTX), YEEPAY, and Splashtop.

Recently, Draper Dragon Innovation, in collaboration with Hong Kong’s Cyberport, established the “Cyberport Draper Dragon Web3.0 Accelerator.” Leveraging Draper Dragon’s entrepreneurial incubation experience from Silicon Valley and Cyberport’s thriving Web3 ecosystem, the accelerator aims to fast-track the practical application and development of Web3 in Hong Kong across multiple dimensions, including talent development, project incubation, and investment, thus supporting Hong Kong’s Web3.0 innovation in alignment with international trends.

——————

Starlabs: From the perspective of VC and primary market research, could you share your insights on the current and future trends in Web 3.0 technology innovation and industry development?

Richard Wang: Technological innovation and its practical application are always two sides of the same coin—interdependent and mutually reinforcing. Moreover, the key drivers behind each market cycle tend to differ. In the last bull market, we saw hot topics like DeFi, NFTs, and GameFi emerge. These innovations followed a phase of technical maturity, particularly in public blockchains such as Ethereum, which attracted attention from developers and entrepreneurs. Only after the ecosystem became more robust did we see the emergence of groundbreaking applications. There’s typically a lag of about 2-3 years between technological readiness and market adoption, much like the time from Ethereum’s mainnet launch to the ICO boom, which also spanned around 2-3 years.

For innovation to thrive, it must align with market resources, particularly the expertise of high-quality entrepreneurs. This trend continues in the current market—technological and application innovations are advancing at their own pace, though this pace is somewhat misaligned with market expectations. For example, the BTCFi sector hasn’t taken off because the existing technology hasn’t yet met the market’s standards for security and innovation. Otherwise, it would be hard to imagine why the trillions of dollars in idle BTC wouldn’t be attracted to even a modest 5% annual yield.

The reason why only BTC and a few other assets have seen significant growth in this cycle is because BTC’s security features have gained broader recognition. A prime example of this is the launch of the US Bitcoin spot ETF.

In fact, several of the new hot areas emerging today—such as RWA (Real-World Assets), DePIN (Decentralized Physical Infrastructure Networks), and AI—share a key characteristic: they all exhibit clear potential for breaking out of their existing circles. Unlike BTC, which breaks out primarily due to its security and scarcity, RWA is expanding the base assets of DeFi into the real economy using financial logic. DePIN extends data sourcing into the physical world, and the fusion of Web 3.0 with AI transforms AI from a data intelligence entity into an economic intelligence entity, leveraging computational power, data, and algorithms. All of these areas show great promise.

From a blockchain perspective, the technical groundwork is already in place. However, these areas of commercial innovation still require entrepreneurial teams to execute. What’s different this time is that the teams driving these innovations need to have more diverse industry backgrounds, meaning the timeline for progress could be longer than in previous cycles.

“The future of Web 3.0 remains highly promising. For investors, staying half a step ahead of the market will still be the key to success.”

—Richard Wang, Managing Partner of Draper Dragon

Starlabs: Draper Dragon has been involved in many AI projects. Given the current landscape, where major players like OpenAI, Microsoft, Google, and Amazon dominate due to their capital, technology, and talent advantages, what opportunities remain for AI startups and SMEs to carve out niches in specific sectors? What are the opportunities and challenges in the intersection of Blockchain and AI? And which conceptual innovations do you find promising?

Richard Wang: From an AI perspective, the main opportunities for startups and SME enterprises lie at the application level. Specifically, there’s potential in combining AI with various scenarios and using knowledge graphs alongside general large models to create specialized domain-specific models. General large models typically rely on open data, but proprietary data within specific scenarios cannot be accessed by these models. As a result, while general models can generate content like text-to-image, text-to-video, or day-to-day dialogue, they fall short in generating specialized content for niche fields.

Specialized fields require specialized models, which presents a clear opportunity for entrepreneurial teams. However, these opportunities aren’t open to everyone. The key challenge is whether startups can acquire data for specific scenarios and continuously build a data moat. A data moat leads to a model moat, which, in turn, creates a market moat.

A particularly unique area is in the realm of smart hardware. In the previous internet business model cycle, hardware was considered a peripheral topic compared to search, social media, and e-commerce, as the core focus was on information aggregation. But in the era of large models, the role of hardware has shifted. Hardware can now play a key role in collecting data for specific scenarios, and it’s not easily replaceable by software. Thus, in the current environment, smart hardware presents an excellent direction.

As for the integration of AI and blockchain, AI takes the lead, while blockchain plays a supportive role. Blockchain can add value to AI in three key areas: computing power, data, and algorithms.

- Data Layer: The assetization of private domain data can significantly expand the data sources available for AI. However, the challenge lies in the standardization of this data. Some projects focus on data collection, while others specialize in data annotation and trading. From a DePIN perspective, additional opportunities arise in decentralized storage, Trusted Execution Environments (TEE), and real-time data acquisition (RAG), among others.

- Computing Power Layer: The core logic of blockchain is to achieve ledger consensus through redundant computation, whereas AI’s development model revolves around “code computation, model refinement, and scenario penetration.” As a result, decentralized computing power has become a typical application in this space. Additionally, permissionless computing based on blockchain architecture can greatly enhance the effectiveness of computational results.

- Algorithm Layer: AI model architectures operate as independent systems where blockchain doesn’t play a direct role in the model itself. However, blockchain can be leveraged for on-chain computation results, facilitating benefit coordination through on-chain transactions. For example, an agent, NPC, or virtual entity could transition from being an intelligent agent to an economic agent based on blockchain technology. Some even propose that “Decentralization + AI = Immortality.”

Starlabs: We’ve noticed that Draper Dragon’s portfolio includes gaming projects like RIGHT TRIGGER and CARV. In your view, how has the GameFi industry evolved and matured in the past 3 -4 years? Looking ahead, do you believe the majority of GameFi’s users and traffic will come from outside Web3 or within the Web3 ecosystem?

Richard Wang: To date, the main innovation in the GameFi business model has been finding the balance between profitability and entertainment value. However, we haven’t seen a truly breakout, phenomenon-level game in the past couple of years. That said, there have been notable advancements in other areas, particularly in terms of user-friendliness. One significant development has been within the Telegram ecosystem, where mini-games have gained traction. These games benefit from a low barrier to entry, resulting in high daily active users (DAU).

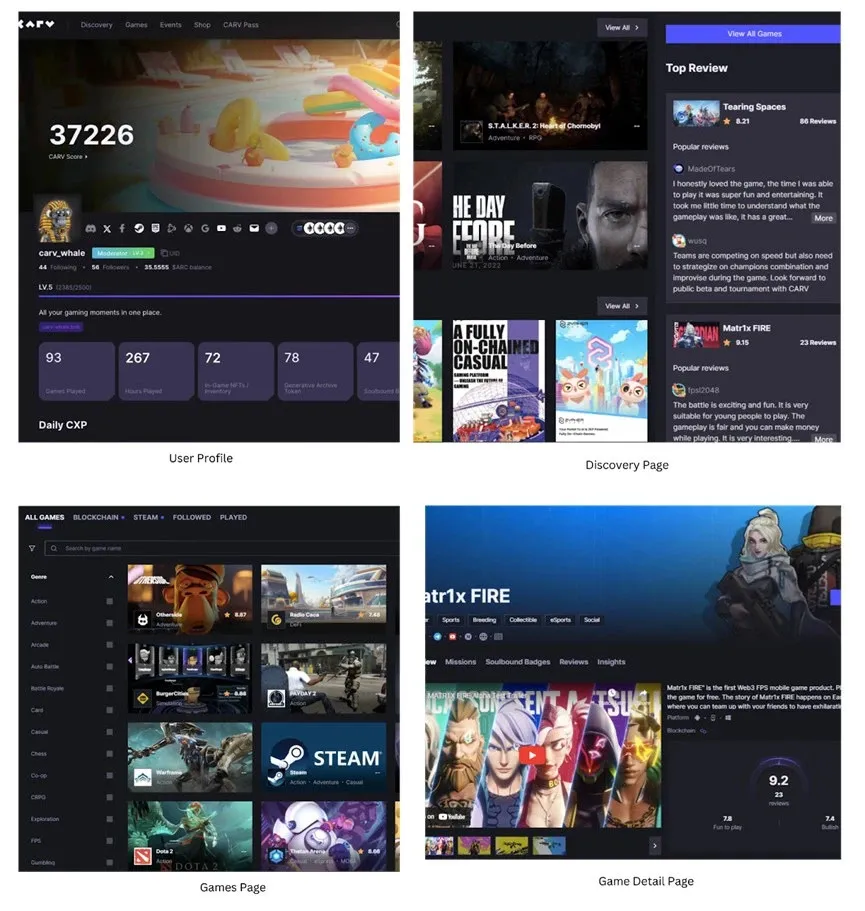

Different platforms, based on their specific attributes, prioritize the development of certain types of games, which creates innovative opportunities for building industry infrastructure based on user identity. For example, CARV Protocol serves as a self-sovereign identity oracle, enabling users to control their own data through a decentralized incentive model, covering both Web2 and Web3 data.

In my view, Web 3.0 games should serve all users, and there shouldn’t be a distinction between Web 2.0 and Web 3.0 users at the user level. The reason such a distinction exists is primarily due to the early-stage technical limitations of Web 3.0 games, which resulted in a significant gap in user experience compared to traditional games. However, as public blockchain performance improves, projects that can match Web 2.0 games in terms of visual effects and game mechanics will undoubtedly emerge. For instance, Right Trigger is a promising contender with this potential.

Starlabs: Could you share your insights on what key factors Draper Dragon focuses on when selecting projects and sectors for investment? Additionally, how can secondary market investors learn from VC investment research strategies and methodologies?

Richard Wang: Since its inception, Draper Dragon has positioned itself as a dual-currency fund focused on early-stage market investments, with projects spanning North America, Europe, and Asia. We have consistently focused on investing in technological innovation and the dividends it can generate through practical application.

For a startup to succeed, it typically takes about 10 years. Even institutions like OpenAI, which have garnered significant attention, have been around for nearly a decade. Early-stage investment relies on specialized knowledge to take on high risks in exchange for potentially high returns. Of all the factors that influence a company’s growth, only technology is able to transcend short- and medium-term economic cycles, such as inventory and monetary cycles. Technology is the only factor that can provide long-term, stable dividends, thus helping to mitigate investment risk. So, in alignment with our strategy, technological innovation is a critical evaluation criterion in our investment process.

From technological innovation to the various stages of application, there will always be excellent investment opportunities emerging. We make investment decisions based on the laws of industry development and the position of a company within its ecosystem in the value chain. We have many examples of this, but I think the most representative case is Bitcoin (BTC). BTC is still in the process of expanding its recognition and realizing its value.

Starlabs: Will regulatory policies be a significant factor when selecting investment targets? What is your outlook on the overall regulatory trends for crypto across major regions in the future?

Richard Wang: Regulation is indeed a critical factor to consider in any investment. In recent years, Europe has tightened regulations around cryptocurrency trading, while the U.S. has clarified its regulatory framework. Meanwhile, Hong Kong has become the first in the world to approve cryptocurrency exchange licenses.

The global shift in regulatory attitudes reflects a transition from initial unfamiliarity to more rational understanding of emerging technologies. Both regulators and society at large now have a clearer view of digital assets, allowing for a more pragmatic approach that embraces their benefits while seeking to mitigate associated risks.

A key principle in Western regulatory theory is “same business, same risks, same regulation.” The advantage of implementing this principle is that it provides market participants with clear guidelines for specific business areas, while also offering a framework for market innovation. For instance, the BTC spot ETF was introduced under such a regulatory regime.

Empirical studies show that the clearer and more actionable a country’s financial regulatory framework is, the more developed its financial markets become in terms of scale and product diversity. Hong Kong, for example, has adopted a similar regulatory approach to digital asset trading.

It’s important to note that Distributed Ledger Technology (DLT), represented by blockchain, fundamentally alters financial products and services. In fact, it can be considered disruptive. Current financial regulatory systems do not fully accommodate these changes. For example, while many countries have implemented regulations for centralized exchanges (CEX), no country has yet introduced specific regulations for decentralized exchanges (DEX) due to the completely different service models, processes, and structures. This necessitates regulatory innovation, both in terms of principles and methods, and such innovation can only emerge through industry practice.

“Thus, the trend for future regulation will be a balance of rule consistency and innovation, which will have a significant impact on the development of the crypto asset industry across various countries and regions.”

—Richard Wang, Managing Partner of Draper Dragon

Starlabs: In your view, which sectors of Hong Kong’s Web3 and blockchain industry are most encouraged by the HK government? What challenges does Hong Kong face in achieving its goal of “Web3.0 innovation in sync with global progress”? Compared to regions like Europe, the U.S., Dubai, and Singapore, what competitive advantages does Hong Kong have in the Web3 space?

Richard Wang: From our perspective, the Hong Kong government’s support for Web 3.0 is comprehensive, thorough, and exploratory (of course, all activities must comply with regulatory guidelines). Web 3.0 represents the next generation of the internet, and as an emerging industry still in its early stages, it’s difficult to predefine many frameworks. That’s why this broad and exploratory support is crucial.

However, Hong Kong’s development of the Web 3.0 industry will also be constrained by its own resource endowments. The city’s advantages lie in its access to capital, talent, and a rule-of-law environment, as well as its efficient regulatory framework. But why, despite its strengths, did Hong Kong fail to capture a significant share of the market and industry divisions during the last internet wave? In my view, the main reason is that Hong Kong lacked industrial support. The internet industry requires integration with various sectors and supply chains, and it is the “Internet+” model that enables the internet industry to expand into vast market spaces. Similarly, while Web 3.0 inherently carries financial characteristics, it also needs to align with industrial foundations.

“If Hong Kong can leverage its proximity to the Mainland Chinese market, combining Hong Kong’s financial strengths with the Mainland’s industrial chain advantages, it could turn its previous disadvantage of lacking industrial support into a significant advantage, especially compared to regions like Singapore, Dubai, or even Western markets.”

—Richard Wang, Managing Partner of Draper Dragon

Starlabs: With the recent surge in “going global” initiatives, what advice would you offer to domestic companies? Given the differences in domestic and international markets and policy environments, what qualities do companies need to possess when expanding internationally, and what pitfalls should they avoid?

Richard Wang: Expanding internationally is essentially a business model characteristic of Web 2.0, while Web 3.0, by nature, is inherently borderless, with no real concept of “going global.” However, whether it’s Web 3.0 or Web 2.0, it’s crucial to address the pain points of local markets. Different demand means different solutions are required to meet it. That said, I also want to emphasize that “going global” is not just about copying what works in one market and applying it elsewhere. It is, in fact, an opportunity for business transformation. It still requires entrepreneurial spirit and a focus on innovation.

——————

About The Guest

Richard Wang, Managing Partner, Draper Dragon

Richard Wang, Master’s in Telecommunications Engineering from National Chiao Tung University in Hsinchu, Taiwan, with 16 years of experience in Silicon Valley in GPS and mobile chip technology. Richard has founded three companies, transitioning from engineer to investor. Before joining Draper Dragon Innovation Fund in 2011, he founded Mass E-Commerce Ltd. and Olea Network, a Silicon Valley tech company developing radar-based wireless heart sensors. His current investment focus includes the semiconductor industry, the metaverse, fintech, artificial intelligence, and the Web3 sector.

Richard is the author of High-Frequency Circuit Design, Understanding Web3.0, and The New Era of Digital Currency: A Complete Guide to Hong Kong’s VSAP and Stablecoins. He has also published several technical papers in IEEE international journals. His investment portfolio includes companies like YeePay, Shendi Technology, Weina Technology, Huanqing Technology, VeChain, IOTex, QuarkChain, XREX, Kronos Research, HumanProtocol, Ink Financial, AiDTech, Dmail, Fog Works, Fusion, QED, Exocore, and Waterfall Network.

About Starlabs Consulting

Starlabs Consulting is a premier strategic and marketing consultancy specializing in the Web3 sector, established in 2018. Our mission is to empower visionary companies to navigate complex challenges across marketing, operations, and growth initiatives, enabling them to excel in a competitive market landscape. With our in-depth knowledge of the Web3 industry and extensive global network, Starlabs Consulting has become a trusted partner for leading Web3 exchanges and projects. Our dedicated team of professionals and their profound understanding of client needs have solidified our reputation as an industry leader.

Website: https://www.starlabsconsulting.com/